2022 Fourth Quarter Facts

• Sales increase by 21.1% currency adjusted (ca) to € 2,197 million (+ 24.3% reported / Q4 2021: € 1,767 million)

• Gross profit margin is at 44.0% (Q4 2021: 48.2%)

• Operating expenses (OPEX) are at € 939 million (Q4 2021: € 795 million) and the OPEX ratio improves to 42.7% (Q4 2021: 45.0%)

• Operating result (EBIT) amounts to € 41 million (Q4 2021: € 65 million), which translates into an EBIT margin of 1.8% (Q4 2021: 3.7%)

• Net earnings are at € 1 million (Q4 2021: € 8 million)

• Arne Freundt becomes CEO and Chairman of the Management Board of PUMA SE

• Maria Valdes appointed as Chief Product Officer and Member of the Management Board

• PUMA athlete Armand “Mondo” Duplantis named Male Athlete of the Year after winning multiple championships and setting a new world record three times in 2022

• PUMA team Morocco writes history by becoming the first African team to reach semifinals at the FIFA World Cup

• PUMA and Manchester City launch special Chinese New Year collection to celebrate the Year of the Rabbit

• PUMA and Scuderia Ferrari launch the SPEEDCAT PRO driver shoes of Charles Leclerc and Carlos Sainz

• PUMA and Paris-based label KOCHÉ launch a new women’s collection that blurs the lines between performance and lifestyle

• PUMA, in collaboration with The Pokémon Company International, launches its creative Pokémon collection

• PUMA obtains Sustainability Leadership Award by Footwear News and a top score for climate change transparency by the non-profit organization CDP 2

• PUMA recognized as a Top Employer in 22 countries across Europe, Asia Pacific, North and Latin America

• PUMA named company of the year at German Diversity Awards • PUMA has closed gender pay gap among German employees, according to externally certified analysis

2022 Full Year Facts

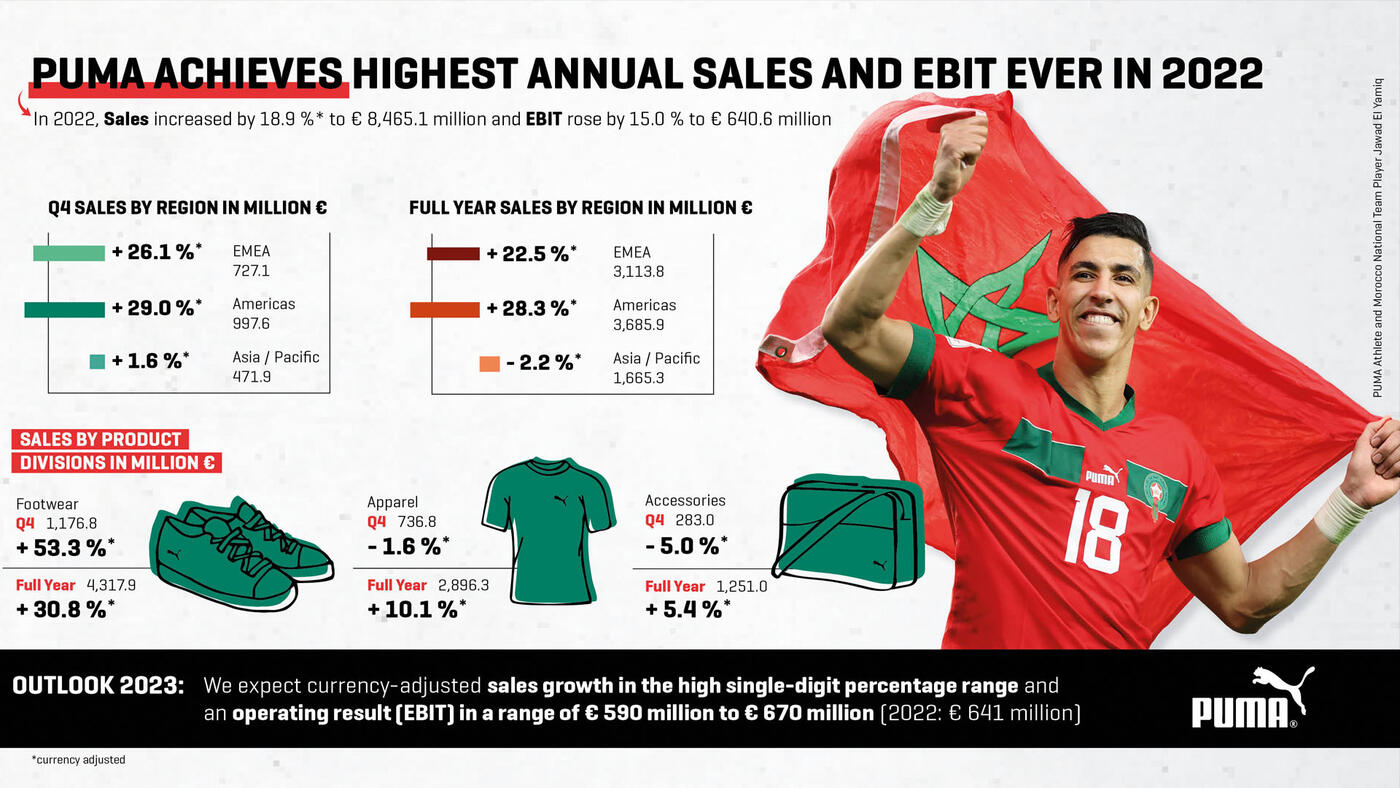

• Sales increase by 18.9% (ca) to € 8,465 million (+ 24.4% reported / FY 2021: € 6,805 million)

• Gross profit margin is at 46.1% (FY 2021: 47.9%)

• Operating expenses (OPEX) amount to € 3,296 million (FY 2021: € 2,725 million) and the OPEX ratio improves to 38.9% (FY 2021: 40.0%)

• Operating result (EBIT) improves by 15.0% to € 641 million (FY 2021: € 557 million), resulting in an EBIT margin of 7.6% (FY 2021: 8.2%) • Net earnings improve to € 354 million (FY 2021: € 310 million)

• Earnings per share improve to € 2.36 (FY 2021: € 2.07)

• A dividend of € 0.82 per share for 2022 to be proposed to the Annual General Meeting

Arne Freundt, Chief Executive Officer of PUMA SE:

“2022 was a record year for PUMA. We accelerated our growth across all product categories and worldwide despite a volatile market environment. This success is thanks to our amazing PUMA Family team and to our great partnerships with athletes, retailers, and suppliers. While facing some economic headwinds in 2023, we remain hungry and will advance the execution of our successful strategy. We will focus on elevating our brand strength and on winning market share in the U.S. and China. I'm honored to have the chance to lead this fantastic company and take PUMA together with my great team to new heights.”

Fourth Quarter 2022

Sales increased by 21.1% (ca) to € 2,196.6 million (+24.3% reported). The Americas region delivered strong sales growth of 29.0% (ca), especially led by the strong performance in Latin America. Sales in EMEA were up 26.1% (ca), driven by strong growth across almost all key markets in Europe. The Asia/Pacific region recorded a sales growth of 1.6% (ca). COVID19 related lockdown measures and geopolitical tensions continued to impact business in Greater China, while other key markets in Asia/Pacific delivered strong growth. Sales in Footwear were up 53.3% (ca), driven by continued strong demand for our Performance categories like Running & Training, Teamsports and Basketball, as well as for Sportstyle. Sales in Apparel and Accessories declined by 1.6% and 5.0% (ca) respectively, mainly because of softer demand in North America and Greater China.

PUMA’s Wholesale business increased by 25.7% (ca) to € 1,557.7 million and the Direct-toConsumer (DTC) business was up by 11.0% (ca) to € 638.9 million. Sales in owned & operated retail stores increased 10.8% (ca) and e-commerce increased 11.4% (ca). The strong growth in our Wholesale distribution channel was supported by our continued focus on being the best partner for our retailers. At the same time, as expected, improved product availability led to stronger growth in the DTC business, especially in e-commerce. The gross profit margin decreased by 420 basis points to 44.0% (Q4 2021: 48.2%), mainly due to an industry-wide increase in promotional activity as a result of high inventory levels in the market. In addition, higher sourcing prices due to raw materials and freight rates as well as an unfavorable distribution channel mix had a negative impact, while price adjustments partially compensated for the negative effects.

Operating expenses (OPEX) increased by 18.1% to € 938.7 million (Q4 2021: € 795.1 million) as a result of higher marketing expenses, a higher number of retail stores in operation as well as higher sales-related distribution costs. The OPEX ratio improved by 230 basis points to 42.7% (Q4 2021: 45.0%) as a result of higher sales growth and continued focus on OPEX control.

The operating result (EBIT) decreased by 37.6% to € 40.5 million (Q4 2021: € 65.0 million) and the EBIT margin came in at 1.8% (Q4 2021: 3.7%).

The taxes on income showed a gain of € 9.6 million (Q4 2021: expense of € 11.2 million) due to an improved outlook for the future utilization of tax loss carryforwards.

Net earnings decreased by 82.0% to € 1.4 million (Q4 2021: € 7.9 million) and earnings per share amounted to € 0.01 (Q4 2021: € 0.05).

Full Year 2022

Sales increased by 18.9% (ca) to € 8,465.1 million (+24.4% reported). The Americas region recorded the strongest sales growth of 28.3% (ca), with Latin America exceeding € 1 billion in sales for the first time in history. EMEA was the second fastest growing region with a sales growth of 22.5% (ca), with all key markets in Europe growing at double digits. Sales in the Asia/Pacific region were down 2.2% (ca) due to COVID-19 related lockdown measures and geopolitical tensions in Greater China, while other major markets in Asia/Pacific recorded strong growth. All product divisions delivered a solid growth, with Footwear being up 30.8% (ca), Apparel up 10.1% (ca) and Accessories up 5.4% (ca).

The Wholesale business was up 22.7% (ca) to € 6,513.7 million and the Direct-to-Consumer business (DTC) increased by 7.8% (ca) to € 1,951.4 million with growth in owned & operated retails stores (+11.0% ca) and e-commerce (+2.2% ca).

The gross profit margin decreased by 180 basis points to 46.1% (FY 2021: 47.9%). This was driven by higher sourcing prices due to raw material price and freight rate increases, a less favorable channel mix and industry-wide promotional activity towards the end of the year. The negative effects were partially offset by price adjustments and currency effects.

Operating expenses (OPEX) increased by 21.0% to € 3,295.9 million (FY 2021: € 2,724.6 million). The increase was driven by higher marketing expenses, a higher number of retail stores in operation, higher sales-related distribution and warehousing costs as well as operational inefficiencies due to COVID-19. However, the respective OPEX ratio improved by 110 basis points to 38.9% (FY 2021: 40.0%) as a result of higher sales growth and continued focus on OPEX control.

The operating result (EBIT) increased by 15.0% to € 640.6 million (FY 2021: € 557.1 million) due to strong sales growth and continued OPEX control. The EBIT margin came in at 7.6% (FY 2021: 8.2%).

The financial result decreased to € -88.9 million (FY 2021: € -51.8 million).This development is mainly attributable to expenses related to forward exchange transactions ("swap points"). In the financial year 2022, earnings before taxes (EBT) increased by 9.2% to € 551.7 million (FY 2021: € 505.3 million). Tax expenses were at € 127.4 million (FY 2021: € 128.5 million) and the tax rate improved to 23.1% in 2022 (FY 2021: 25.4%).

Net earnings improved by 14.2% to € 353.5 million (FY 2021: € 309.6 million) and earnings per share were at € 2.36 (FY 2021: € 2.07).

Working Capital

The working capital increased by 49.3% to € 1,086.8 million (December 31, 2021: € 727.9 million). Inventories were up by 50.4% to € 2,245.1 million (December 31, 2021: € 1,492.2 million), representing a good improvement compared to the year-over-year growth rate of 72.3% at the end of Q3. The increased inventory level is strongly impacted by earlier product 6 purchasing to mitigate the impacts of the disrupted supply chain as well as higher sourcing prices due to raw material price and freight rate increases. Trade receivables increased by 25.6% to € 1,064.9 million (December 31, 2021: € 848.0 million), mainly as a result of strong sales growth. On the liabilities side, trade payables increased by 47.5% to € 1,734.9 million (December 31, 2021: € 1,176.5 million).

Cash Flow and Liquidity Situation

The free cash flow decreased by 35.7% to € 177.5 million in 2022 (FY 2021: € 276.2 million). As of December 31, 2022, PUMA had cash and cash equivalents amounting to € 463.1 million, a decrease of 38.9% compared to end of 2021 (December 31, 2021: € 757.5 million). In addition, the PUMA Group had credit lines totaling € 1,271.0 million as of December 31, 2022 (December 31, 2021: € 1,322.0 million). Unutilized credit lines were at € 943.7 million on the balance sheet date, compared to € 942.0 million at the end of 2021.

Proposal of a Dividend of € 0.82 per share

Based on the positive net earnings in 2022, the Management Board and Supervisory Board will propose to the Annual General Meeting on May 24, 2023 to distribute a dividend of € 0.82 per share for the financial year 2022. The payout ratio for the financial year 2022 will be 34.7% (FY 2021: 34.8%) of the consolidated net earnings according to IFRS and is in line with PUMA SE's dividend policy, which foresees a payout ratio of 25% to 35% of consolidated net earnings.

Brand & Strategy Update

Faced with the ongoing COVID-19 pandemic and the war in Ukraine in 2022, we put the wellbeing of our PUMA Family first and kept a flexible and pragmatic mindset to execute our strategy and continue our strong growth momentum. 7 From the beginning of the war, we focused on our employees, athletes and partners in Ukraine. We offered safe accommodation in Western Ukraine and welcomed many employees and their families in Germany and Poland, where we also helped with work permits and jobs. PUMA also helped with product donations for aid organizations in Ukraine to get help to those who needed it most.

While the COVID-19 pandemic eased in Europe and the Americas, the situation in 2022 remained challenging in parts of Asia, especially in China, where our employees did an exceptional job despite the repeated lockdowns. The tireless work of our sourcing teams ensured that supply chain disruptions were kept to a minimum throughout the year.

Providing an attractive workplace is an important part of our people strategy, which is why we were very honored to be named “Global Top Employer” for the first time in early 2023. In 2022, we also received several recognitions as an employer such as “Company of the Year” at the German Diversity Awards.

At the start of 2023, a gender pay gap analysis, which was independently certified, showed that PUMA has closed the pay gap between men and women among its employees in Germany. This makes PUMA the second company in Germany to receive the title “Universal Fair Pay Developer" by organization FPI Fair Pay Innovation Lab.

PUMA kept its eight strategic priorities unchanged in 2022: brand heat, product ranges that are right for our consumers, a comprehensive offer for women, quality of our distribution, speed and efficiency of our organizational infrastructure, re-entry into Basketball to improve our position in North America and a focus on local relevance as well as sustainability.

As a sports company, the successes of PUMA’s sponsored athletes and teams increase our brand heat.

In 2022, our PUMA team Morocco sensationally reached the semifinals of the FIFA World Cup in Qatar, becoming the first African team to do so in the history of the tournament. Our players Antoine Griezmann, Olivier Giroud and Raphaël Varane were in France’s starting 8 line-up in the final. Neymar Jr. scored his 77th goal for Brazil, equaling the record of football icon and PUMA player Pelé.

In club football, our PUMA teams AC Milan and Manchester City won the league titles in Italy and England, while Olympique de Marseille and Borussia Dortmund came in second in France and Germany. In the Netherlands, PSV Eindhoven won the Dutch Cup.

At the end of the season 2021/22, we secured a long-term extension to our partnership with AC Milan and became the official naming partner of the club’s training center for future talents, which will be called the “PUMA House of Football.” We also expanded our reach in football, as we became the official match ball provider of the Italian football league Serie A, starting from the 2022/23 season.

At the World Athletics Championships in Eugene, Oregon, USA, Jamaican sprinter Shericka Jackson ran the second fastest 200m time in history, Portuguese athlete Pedro Pichardo took the gold in the triple jump with the best performance of 2022 and Swedish pole vaulter Armand “Mondo” Duplantis set yet another world record of 6.21 meters. Because of his amazing performances in 2022, Mondo was named “Male Athlete of the Year”. Our Ukrainian PUMA athlete Yaroslava Mahuchikh won gold in the high jump at the World Indoor Championships in Belgrade, Serbia and the European Championships in Munich, Germany.

Throughout the year, we added several new track and field ambassadors to our roster such as Mutaz Essa Barshim, Elaine Thompson-Herah, Abby Steiner and Emmanuel Korir. In early 2023, Olympic 100m Champion Marcell Jacobs also joined the PUMA Family.

With Scuderia Ferrari, Red Bull Racing and Mercedes AMG Petronas, PUMA partnered with the most successful teams of the 2022 Formula 1 season. The increasing popularity of motorsport, and Formula 1 in particular, amplifies these strong partnerships, especially in the United States, where Miami hosted its first Grand Prix in 2022, which was immediately sold out.

In Golf, Cobra PUMA Golf athlete Ewen Ferguson won the Commercial Bank Qatar Masters and the ISPS Handa World Invitational, while Olivia Cowan claimed her maiden Ladies 9 European Tour Victory in India at the Hero Women’s Open. Lexi Thompson won the title at the Aramco Team Series in New York.

Working with ambassadors from culture, music and fashion also creates brand heat for PUMA and helps us to connect with our Gen Z audience. In 2022, we announced a long-term partnership with British-Nigerian rapper and record producer Skepta, with whom we developed a global media campaign for the RS-X sneaker, and who will also design his own PUMA collections.

At the New York Fashion Week, our spectacular FUTROGRADE show took place both on the runway and in the virtual world. The show was curated by PUMA Creative Director June Ambrose, with special appearances by PUMA ambassadors such as Winnie Harlow, Kyle Kuzma, Davido and Usain Bolt.

With the FUTROGRADE event, we continued to explore the possibilities of Web3. We sold two exclusive NFTs (Non Fungible Tokens) as part of the event: A collectible NFT and another which could be exchanged for a pair of futuristic sneakers in the real world.

Whether it is Web3, the Metaverse or NFTs, the virtual world is becoming increasingly relevant for our young audiences. In 2022, we unveiled our largest Web3 collaboration to date with 10KTF and launched “PUMA and the Land of Games” on the online gaming platform Roblox. This virtual environment was also used to launch a real product, Manchester City’s new third kit.

In 2022, we significantly improved our product offering across all business units.

Our performance footwear, especially the running styles VELOCITY and DEVIATE which feature PUMA’s NITRO technology, showed strong sell-through and won awards such as the Runner’s World Editor’s Choice Gold Medal.

We expanded our product offering in Running & Training and introduced our SEASONS collection, a range of outdoor items made to protect against the elements all year round.

Our innovative PUMA ULTRA and FUTURE as well as the classic KING football boots were very successful and gained market share throughout the year. For the FIFA World Cup in Qatar, we launched our football boots in the “Fearless Pack” edition. They were worn by 105 players in the tournament and very visible on pitch thanks to their striking colors.

We reintroduced an important sneaker style from our archives, the SLIPSTREAM, which was presented by PUMA ambassadors such as Neymar Jr, Danna Paola and Romeo Beckham in a global campaign. As part of our collaborations with AMI Paris, MCM, Palomo Spain, Vogue, Pokémon, Garfield and others we created fashion-forward Sportstyle collections that resonated well with our customers.

Our women’s offering also benefited from the launch of innovative products in Sportstyle, Teamsport, Basketball and other business units in 2022.

Global pop superstar Dua Lipa headed the campaigns for successful women’s styles such as the MAYZE and the SLIPSTREAM in 2022, and she presented the second drop of her own collection called “Flutur”, which featured bold designs and colors.

To capture the increasing popularity of women’s football at the UEFA Women’s Euro in England, we launched special editions of the FUTURE 1.4 and the ULTRA ULTIMATE football boots in women’s specific fits. With Austria, Iceland, Italy and Switzerland, PUMA supported four teams and more than 70 individual players at the tournament.

Our strategy to offer women’s specific fits in performance sports included Basketball, where we presented the Stewie 1, the first signature shoe for a female athlete in over a decade with WNBA star Breanna “Stewie” Stewart.

The success of our athletes in basketball has increased our credibility in the sport, an important part of our positioning in the North American market. PUMA Basketball athlete LaMelo Ball became the fourth-youngest player to compete in the NBA All Star Game, while Marcus Smart was named NBA Defensive Player of the Year and Jackie Young the most improved player of the year in the WNBA.

Our partnership with LaMelo Ball has also been a great commercial success, with the introduction of his first signature shoe, MB.01, which quickly sold out in several styles and colors. In 2022, we continued this successful collaboration with several versions of LaMelo’s second shoe, the MB.02, for which we also saw very good sell-through.

To improve our distribution reach around the world, we launched our PUMA.com online store in the Philippines, Thailand, Norway, Saudi Arabia and several other new countries in the Middle East and Africa, now servicing consumers in more than 50 countries. For our most loyal consumers we created our new PUMA Shopping App which offers virtual try-ons of selected products and a simple check-out process. The App was launched in India, the USA, the UK and Japan in 2022 with further markets to follow in 2023 and received great ratings by our consumers. We also expanded our network of PUMA Stores around the world, including new flagship stores in Singapore and Buenos Aires.

It is important for us to complement our international offer with products that have strong local relevance. This also includes our presence in sports such as cricket, rugby, padel or handball, where PUMA team Denmark won the Men’s Handball World Championship for a record-breaking third time in a row in early 2023. We also signed new locally relevant brand ambassadors, such as pop singers Eleni Foureira from Greece, Teodora from Serbia or most recently the captain of the women’s Indian Cricket Team Harmanpreet Kaur.

To reach out to young audiences who are particularly concerned about sustainability, the environment and climate change, we held our first ‘Conference of the People’ in London. In an open conversation about sustainability in our industry, our industry peers, activists, NGOs, experts and ambassadors joined Gen Z representatives on stage. We took the opportunity to explain our Forever Better sustainability strategy in great detail, including the RE:SUEDE and RE:JERSEY circularity projects. But we also listened and gathered valuable feedback on how to talk to young generations about sustainability.

As part of our biodegradability experiment RE:SUEDE, 500 volunteers in Germany tested an experimental version of our iconic SUEDE for half a year before returning the worn sneakers to us. PUMA will now explore whether they can be biodegraded in a controlled industrial setting. 12 Our circularity project RE:JERSEY was introduced with PUMA football teams Manchester City, AC Milan, Borussia Dortmund, Olympique de Marseille and Girona FC. Here we trialed a novel chemical recycling process, which turns old polyester garments into yarn for new products. We expect to scale up this process in the coming years to help reach our circularity and recycling goals.

On a corporate level, we announced that we had reduced our own carbon emissions and those coming from our supply chain between 2017 and 2021, even though the business grew strongly in the same period.

These and other sustainability efforts were recognized when industry publication Business of Fashion named PUMA the most sustainable brand in a ranking of 30 companies. We also received the Footwear News Sustainability Leadership Award and were given the highest possible mark for our transparency and performance on climate change by not-for-profit charity CDP.

In terms of organization, Arne Freundt was appointed as CEO and Chairman of the Management Board of PUMA SE in November. Arne has more than ten years of experience at PUMA and most recently worked as Chief Commercial Officer and as a Member of the Management Board. He replaces Bjørn Gulden, who left the company in 2022 after nine years as CEO. Our management board was strengthened to four members when Maria Valdes was appointed Chief Product Officer in December.

In April, Héloïse Temple-Boyer became the new Chair of PUMA’s Supervisory Board. She has been a part of the Supervisory Board since 2019 and is a member of the Audit Committee.

Outlook 2023

PUMA achieved another record in sales and operating result (EBIT) in the financial year 2022. We delivered the strong growth based on our continued brand momentum, successful product launches and the best possible service for our athletes, retail partners and consumers. As people make the difference, a significant part of our momentum is due to our highly engaged employees.

Despite the strong growth in 2022, we continue to face a high degree of geopolitical, macroeconomic and commercial uncertainty. The war in Ukraine, the threat of recession, high inflation and high interest rates are resulting in volatile retailer and consumer demand. In addition, we are seeing increased inventory levels across our industry, which contribute to a competitive market environment. For 2023, we assume that there will be no further deterioration of the above mentioned factors and expect a normalization of market conditions in the U.S. and China.

Considering PUMA's strong momentum, we expect currency-adjusted sales growth in the high single-digit percentage range and operating result (EBIT) in a range of € 590 million to € 670 million (2022: € 641 million) for the financial year 2023. PUMA’s net earnings are expected to change accordingly.

The development of the gross profit margin and OPEX ratio will largely depend on the extent and the duration of the negative impacts described above. Given the timing of these unfavorable factors, we expect the gross profit margin to be under more pressure in the first half of the year than in the second half. For the full year 2023, PUMA expects currencies, higher freight rates and raw material prices to again dilute profitability.

In line with previous years, PUMA will continue to focus on managing short-term challenges without compromising the mid- and long-term momentum of the brand. Our sales growth and market share gains will have priority over short-term profitability. The exciting product range for 2023 and the very good feedback from retail partners as well as consumers make us confident for the mid- and long-term success and continued growth of PUMA.