2019 Fourth Quarter Facts

- Sales increase by 20.6% reported to € 1,479 million (+18.3% currency adjusted) with double-digit growth in all regions and product divisions

- Gross profit margin improves to 47.3%

- Operating expenses (OPEX) increase by 19.4% reported due to higher sales related costs as well as higher marketing and retail investments

- Operating result (EBIT) up by 46.8% to € 55 million

- In Formula 1, PUMA athlete Lewis Hamilton wins drivers championship for the sixth time and PUMA team Mercedes AMG Petronas wins the constructors´championship

- PUMA and BALMAIN join together to debut their first collaboration, created with Cara Delevingne

- PUMA partners with Grammy-winning artist J.Cole

- PUMA announces partnerships with German Handball Federation (DHB) and football club PSV Eindhoven, both starting July 2020

2019 Full-Year Facts

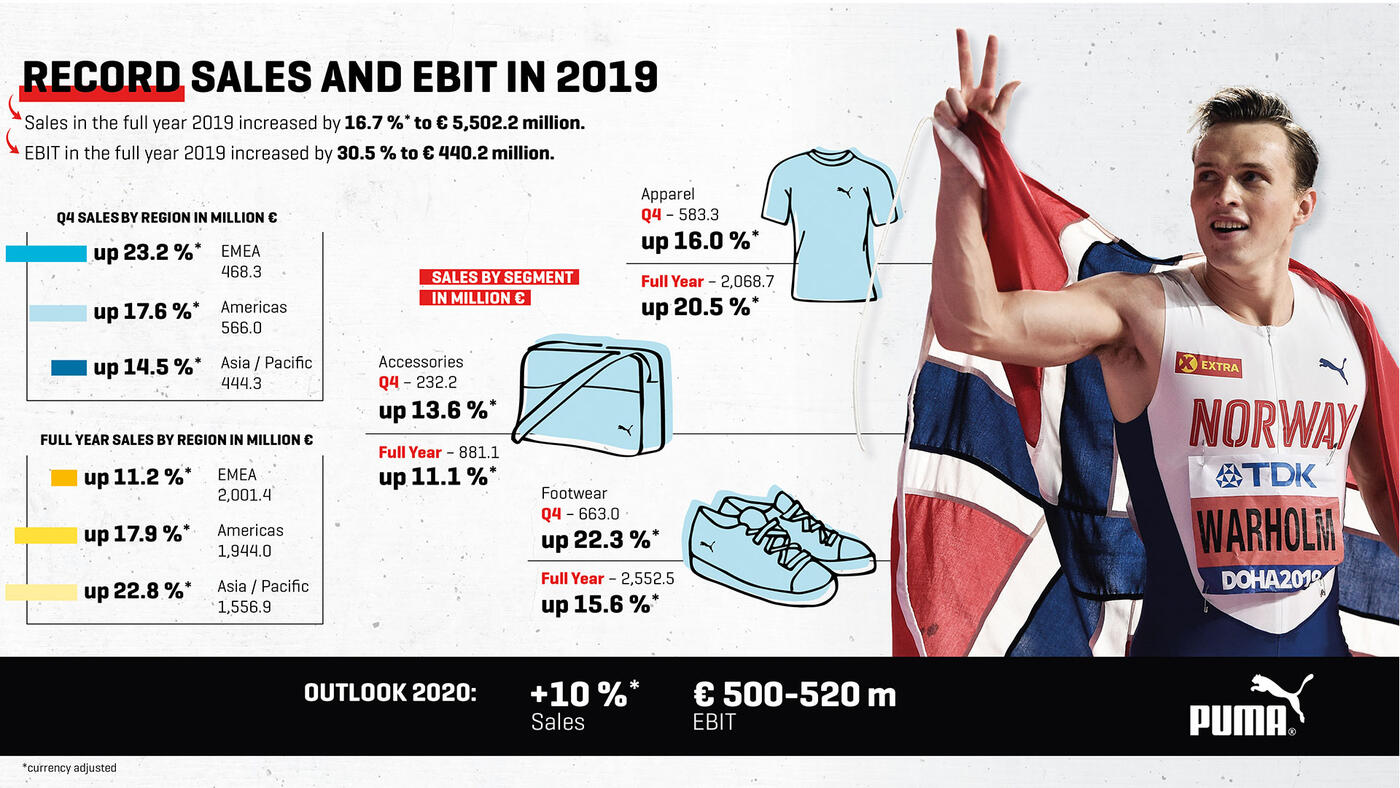

- Sales increase by 18.4% reported to € 5,502 million (+16.7% currency adjusted)

- Gross profit margin up by 40 basis points at 48.8%

- Operating expenses (OPEX) increase by 17.8% (reported) at a slightly lower rate than reported sales

- Operating result (EBIT) improves by 30.5% from € 337 million to € 440 million

- Net earnings increase by 40.0% from € 187 million last year to € 262 million and earnings per share increase from € 1.25 last year to € 1.76 correspondingly

- Proposal of an increased dividend of € 0.50 per share for 2019 at the Annual General Meeting (2018: € 0.35 per share)

Bjørn Gulden, Chief Executive Officer of PUMA SE:

“2019 ended with a very strong fourth quarter for us with revenues being up 20.6% reported (18.3% currency adjusted) and EBIT up 47%. All regions and all product divisions were up by double digits. This made 2019 the best year in PUMA‘s history with a revenue of € 5.5 billion (+ 18.4%) and an EBIT of € 440 million (+30%). I am very proud of what the team has achieved and think this performance shows the global potential of the PUMA brand.

After a good start into 2020, February has of course been negatively affected by the outbreak of COVID-19. The business in China is currently heavily impacted due to the restrictions and safety measures implemented by the authorities. Business in other markets, especially in Asia, is suffering from lower numbers of Chinese tourists.

Given the current uncertainty around the virus it is of course impossible to forecast its impact on the business. We will do everything we can in the short term to minimize the damage and remain very positive in the long term both for our industry and for PUMA.”

Fourth Quarter 2019

Sales

PUMA's strong sales growth continued in the fourth quarter of 2019. Sales increased by 20.6% reported to € 1,478.6 million (+18.3% currency adjusted). All regions and all product divisions contributed with double-digit increases. Sportstyle, Running and Training as well as Motorsport were the categories with the highest growth rates.

Gross Profit Margin and Operating Expenses

The gross profit margin improved to 47.3% in the fourth quarter (last year: 47.1%). Small positive mix effects as well as slightly positive currency effects led to margin improvements.

Operating expenses (OPEX) rose by 19.4% to € 650.6 million in the fourth quarter. The increase was mainly caused by higher sales-related costs, including logistics costs as well as higher marketing and retail investments.

Operating Result and Net Earnings

The operating result (EBIT) increased by 46.8% from € 37.6 million last year to € 55.2 million due to a strong sales growth combined with an improved gross profit margin and operating leverage.

Net earnings increased by 55.0% from € 11.5 million to € 17.8 million and earnings per share were up from € 0.08 in the fourth quarter last year to € 0.12 this year.

Full Year 2019

Sales

PUMA's sales increased by 18.4% reported in the financial year 2019 (+16.7% currency adjusted). All regions and product divisions contributed with double-digit growth.

In the EMEA region, sales rose by 11.2% reported to € 2,001.4 million (+11.2% currency adjusted). As a result, the EMEA region exceeded the two billion Euro sales mark for the first time. The main growth drivers were Germany, Spain, Russia, and Turkey.

In the Americas region, sales increased by 20.6% reported to € 1,944.0 million. Currency adjusted sales increased by 17.9%. Both North America and Latin America contributed with double-digit growth rates. Currency exchange effects for North America were positive, while especially the weakness of the Argentinian Peso led to a negative currency effect on sales for Latin America.

The Asia/Pacific region delivered the strongest sales growth of 26.0% reported to € 1,556.9 million. This corresponds to a currency adjusted increase of 22.8%. Growth in the region was mainly driven by China and India.

In the Footwear division, sales increased by 16.8% reported to € 2,552.5 million. Currency adjusted sales increased by 15.6%. The strongest growth was achieved in the Sportstyle, Running and Training, and Motorsport categories.

In the Apparel division, sales increased by 22.6% reported to € 2,068.7 million (+20.5% currency adjusted) and was also driven especially by strong growth in Sportstyle, Running and Training as well as Motorsport categories. As a result, sales in the Apparel division exceeded the two billion Euro sales mark for the first time.

The Accessories division showed a sales increase of 13.5% reported to € 881.1 million. This corresponds to a currency adjusted sales growth of 11.1%. Higher sales of legwear, bodywear and Cobra golf clubs contributed to the increase.

Wholesale continued to drive growth with an increase of 15.0% currency adjusted, supported by a strong performance of our key accounts. PUMA's direct-to-consumer sales (owned and operated retail stores and eCommerce) increased by 22.0% currency adjusted to € 1,395.3 million. This was driven by like-for-like sales growth in our own stores, the expansion of our retail store network and a continued strong growth of our eCommerce business. Direct-to-consumer sales represented a share of 25.4% of total sales in 2019 compared to 24.3% in 2018.

Gross Profit Margin and Operating Expenses

PUMA's gross profit in the financial year 2019 increased by 19.4% from € 2,249.4 million to € 2,686.4 million. The gross profit margin improved by 40 basis points from 48.4% to 48.8%. The main drivers were product mix, regional mix, channel mix as well as a slightly positive currency effect. Gross profit margin improved in Footwear from 45.8% in 2018 to 46.4% in 2019, in Apparel from 50.9% to 51.1% and in Accessories from 50.3% to 50.5% respectively.

Operating expenses (OPEX) increased by 17.8% and amounted to € 2,271.3 million. The increase was driven by higher sales-related variable costs as well as costs related to IT infrastructure, marketing and our own retail business. The OPEX ratio in percent of total sales decreased from 41.5% in 2018 to 41.3% in 2019.

Operating Result and Net Earnings

The operating result (EBIT) improved by 30.5% from € 337.4 million in 2018 to € 440.2 million in 2019. This was slightly above the upper end of the revised EBIT guidance of € 420 million to € 430 million. This result was achieved through strong sales growth combined with a higher gross profit margin and operating leverage. EBIT margin went up from 7.3% in 2018 to 8.0% in 2019.

Despite the additional interest expense of € 29.7 million related to the new accounting standard for leases (IFRS 16), the financial result improved slightly from € -24.0 million in 2018 to € -22.6 million in 2019). This positive development is primarily the result of gains from currency conversion differences of € 10.2 million in 2019, compared to a loss from the currency conversion of € -14.4 million last year.

The tax rate for the full year 2019 amounted to 26.0% compared to 26.7% last year and the total tax expense increased from € 83.6 million in 2018 to € 108.6 million in 2019.

Net earnings rose by 40.0% from € 187.4 million last year to € 262.4 million in 2019. This translated into improved earnings per share of € 1.76 compared to € 1.25 in 2018, considering the 1:10 stock split.

Working Capital

Despite the significant growth in sales and an increased number of own retail stores, working capital rose only by 9.0% from € 503.9 million to € 549.4 million. Inventories grew by 21.3% from € 915.1 million in 2018 to € 1,110.2 in 2019. Earlier purchase of products to balance supplier capacities and secure product availability, more retail stores and the expected sales growth led to the increase. Trade receivables rose by 10.5% from € 553.7 to € 611.7 million due to active receivables management. On the liabilities side, trade payables increased by 19.6% from € 705.3 million to € 843.7 million, mainly related to purchases of product.

CashFlow

The free cash flow (before acquisitions) improved by € 181.8 million to € 331.2 million in 2019. This development was a result of considerably higher earnings before taxes (EBT € +104.2 million) and the only moderate increase in working capital. In addition, the first-time application of the new lease accounting standard (IFRS 16) in the financial year 2019 had a positive effect of € 170.5 million. Without this positive effect, the free cash flow (before acquisitions) in 2019 would have improved by € 11.3 million, despite a significant increase of investments in fixed assets of € 88.2 million in 2019 compared to last year. Please refer to the Notes to the Consolidated Financial Statements, chapter 1 General, for a detailed description of the effects of the first-time application of IFRS 16 Leases.

As of December 31, 2019, PUMA’s cash position amounted to € 518.1 million compared to € 463.7 million at the balance sheet date last year.

Proposal of a Dividend of € 0.50 per share

Based on PUMA’s continued positive business development in 2019 with an improvement of profitability and cash flow, the Management Board and the Supervisory Board of PUMA SE will propose to the Annual General Meeting on May 7, 2020, a dividend of € 0.50 per share for the financial year 2019 (last year € 0.35). This represents a payout ratio of 28.5% as a percentage of net earnings, in line with PUMA SE's dividend policy, which foresees a payout ratio of 25% to 35%.

Brand and Strategy Update

In 2019, PUMA continued to work hard towards our ambition of becoming the fastest sports brand in the world. To further strengthen our sports performance positioning we entered into many new partnerships with internationally renowned football clubs and increased the brand’s visibility at key sports events globally through great performances of our sponsored athletes and teams.

PUMA has set out six strategic priorities: brand heat, a competitive product range, a leading offer for women, improving our distribution quality, organizational speed and building our sports performance credibility in the US through our re-entry into Basketball.

In our Teamsport category, 2019 started with a big announcement, as we launched our partnership with Manchester City in February. This deal is PUMA’s largest ever, both in terms of scope and ambition. We were also excited to welcome Pep Guardiola, one of the most celebrated football managers in the world, as a brand ambassador.

In Spain, we signed Valencia CF, one of the most respected clubs in Spanish football. We also became the official match ball partner of Spanish football league LaLiga Santander and LaLiga 1|2|3. All goals in one of Europe’s strongest professional football leagues are scored with the PUMA LaLiga 1 football.

PUMA is now in the position to have a title-contending presence in all major football leagues and with the national teams of Egypt and Morocco recently joining the PUMA family, we now sponsor 12 federations.

One of the highlights of the football year was the Women’s World Cup in France, during which PUMA sponsored team Italy and 78 PUMA players ensured high visibility for the brand.

Our PUMA teams and athletes were also successful in other teamsport events around the globe such as Handball, Netball, Australian Rules Football, Cricket, and Rugby.

The World Athletics Championships in Doha were an important event for our track and field athletes. PUMA was highly visible during the competition, as we supported a total of 115 athletes and twelve national federations. Norwegian hurdler Karsten Warholm successfully defended his title over 400m hurdles and was later voted European Male Athlete of the Year. During the competition 22 medals were won by athletes wearing PUMA.

In June of 2019, PUMA signed rising pole vault star Armand “Mondo” Duplantis, a partnership that already proved very successful. The US-born Swede broke the world record twice in early 2020, most recently setting it at 6 meters 18 at the World Athletics Indoor Tour in Glasgow.

PUMA also welcomed new partners in Motorsport. We signed a long-term agreement with Porsche as well as a separate collaboration with Porsche Design to create premium lifestyle products.

Our Formula 1 teams Mercedes AMG Petronas, Scuderia Ferrari and Aston Martin Red Bull Racing once again dominated the Formula 1 season, where PUMA further expanded its leading presence by becoming the official trackside retail partner for F1 race weekends. Our brand ambassador Lewis Hamilton was crowned Formula 1 Champion for the sixth time.

PUMA also partnered with W Series, the first racing competition for upcoming female talent in motorsport.

In our Golf category, we celebrated the 10-year anniversary with golf ambassador Rickie Fowler, one of the most vibrant ambassadors of the brand. The latest addition to our roster of golf players, Gary Woodland, won the US Open in June.

In PUMA’s first full NBA Basketball season - after our return to the sport in 2018 - Toronto Raptors shooting guard Danny Green was the first PUMA athlete to win the NBA Finals since Isiah Thomas in 1990. With the support of JAY-Z, our Creative Director for basketball, we continued to launch additional performance basketball shoes including the UPROAR and the CLYDE HARDWOOD. We also signed new highly talented NBA players such as RJ Barrett (New York Knicks), Kyle Kuzma (Los Angeles Lakers) and Marcus Smart (Boston Celtics). Our products were very visible on court throughout the NBA Season, the All-Star Game, the Playoffs and the NBA Finals.

Only last week, we also signed a multi-year partnership with Grammy-winning recording artist J. Cole, a brand ambassador who combines basketball, fashion and music culture.

One of our most successful Footwear styles in 2019 was the RALPH SAMPSON, a classic basketball silhouette. This shows that were are generating credibility in basketball, which we leverage into other categories. In the “chunky”-shoe category, the RS-X-franchise continued to resonate well with our customers. The CALI franchise, presented by PUMA’s ambassador Selena Gomez, continued to do well within the women’s lifestyle category. Other key styles included the PUMA FUTURE football boot and running & training shoes based on our LQD CELL and HYBRID technology platforms. In the fourth quarter, we launched the RS-X3, CALI SPORT and the RIDER, which is inspired by one of the jogging shoes launched in the 1980s. With these models, we see ourselves in a good starting position for 2020.

Our women’s brand ambassadors contributed with individual collections in 2019: Selena Gomez launched her second collection. Cara Delevingne teamed up with PUMA and French luxury fashion house Balmain, while Adriana Lima presented a line of boxing inspired styles. Overall, we saw strong growth across our Apparel portfolio, especially from “Big Cat” logo applications and motorsport.

As eSports is becoming increasingly relevant for our consumers, PUMA announced its first-ever partnership in virtual sports with eSports team cloud9. We also for the first time created products specifically around the needs of eSports athletes and gamers, such as an active gaming seat andgaming shoe. Through these partnerships, we are in a position to benefit from the fast-growing gaming and eSports markets.

Our first smartwatch launched in partnership with Fossil Group and Qualcomm helps athletes train, stay motivated, track goals and connect with others while on the go.

In August, we opened our New York flagship store on Fifth Avenue, which provides a deeply immersive brand experience. Customers can find the latest PUMA products, race down the streets of NYC in our Formula 1 race simulators, test the latest PUMA football boots in a virtual San Siro Stadium or personalize their shopping in our customization studio.

On the operational side, we continued to invest in our distribution and logistics network. The construction of our new highly automated multichannel distribution center in Geiselwind, Germany is largely finished and the installation of the intralogistics system has started. Geiselwind is expected it to be operational in early 2021 as planned. In addition, PUMA North America announced the opening of a new also highly automated distribution hub just outside of Indianapolis for 2020.

In addition to our business priorities, social, economic and environmental sustainability remains a core value for PUMA. In 2019, we already achieved 9 out of our 10FOR20 sustainability targets and developed our next set of targets for 2025, which will be announced in 2020. We continued our leading role in the Fashion Charter for Climate Action under the umbrella of UN Climate and joined the Fashion Pact, a global coalition of fashion companies, suppliers and distributors which seeks to make the industry as a whole more sustainable. Our long-standing social compliance program is recognized by the Fair Labor Association and we have been an accredited member since 2007.

Outlook 2020

Our business developed strongly in 2019, both in terms of sales and profitability. We are confident that the positive development will continue in 2020.

For the full year 2020, we therefore expect currency adjusted sales growth of around 10%. We forecast the gross profit margin to show a slight improvement compared to last year (2019: 48.8%) and operating expenses (OPEX) to increase at a slightly lower rate than sales. Based on the current exchange rate levels we expect an operating result (EBIT) for the financial year 2020 in a range between € 500 million and € 520 million (2019: € 440.2 million). We also expect a significant improvement of net earnings in 2020.

The corona virus has negatively impacted our business since the beginning of February. This is especially true in China where more than half of both own and operated and partner stores are temporarily closed due to restrictions of the local authorities. Business is further impacted in other markets, especially in Asia, due to decline of Chinese tourism business. We expect this also to have a negative impact on our total Sales and EBIT for the first quarter 2020.

The uncertainty regarding the duration of the COVID-19 outbreak and the total impact it could have makes it difficult to forecast the business, but we are currently working under the assumptions that the situation will normalize in the short term and that we then will be able to achieve our full year targets.

Find our Financial Calendar for the Full Year 2020 here.