2022 First Quarter Facts

- Sales increase by 19.7% currency adjusted (ca) to € 1,912 million (+23.5% reported / Q1 2021: € 1,549 million)

- Gross profit margin declines to 47.2% (Q1 2021: 48.5%) • Operating expenses (OPEX) increase 18.6% while OPEX ratio improves

- Operating result (EBIT) improves by 27.0% to € 196 million (Q1 2021: € 154 million)

- EBIT margin increases by 30 basis points to 10.3% (Q1 2021: 10.0%)

- Net earnings improve by 11.2% to € 121 million (Q1 2021: € 109 million)

- PUMA partners with French fashion brand AMI in an exclusive collaboration

- PUMA releases special edition of LaMelo Ball's signature basketball shoe MB.01

- PUMA teams up with Alfa Romeo F1 Team ORLEN to equip China’s first F1 driver Zhou Guanyu and Valtteri Bottas with race gear

- PUMA and the Italian Lega Serie A announce new long-term partnership to start in season 2022/23

- PUMA trials garment to garment recycling in circularity project RE:JERSEY, using old football kits to produce new ones

- Neymar Jr. and PUMA launch the FUTURE Instinct football boot edition

- PUMA brand campaign “SHE MOVES US” continues with runner Molly Seidel and footballer Sara Björk Gunnarsdottir

- PUMA signs multi-year contract with the Brazilian Confederation of Athletics (CBAt)

BJØRN GULDEN, CHIEF EXECUTIVE OFFICER OF PUMA SE:

“We have had a very good start into 2022. Despite of all the obstacles and uncertainties, we achieved a sales growth of 20% to € 1,912 million and an EBIT growth of 27% to € 196 million in the first quarter. The demand for our products was high, both from retailers and consumers, and our operations people were able to move enough product through a tight supply chain to partly fulfill this increasing demand. I am very happy to see that the growth is coming from all product divisions and all business units. We have had the highest growth rates in the performance categories like Running, Football, Basketball and Golf, which confirms that our investments into innovation and marketing are paying off. Based on such a strong first quarter, we would normally raise our outlook for the full year. But given the increased uncertainty in the world, we have decided to stick to our initial outlook from the beginning of this year. The COVID-19 outbreak in China, the crisis in Ukraine, a very tight freight situation and inflationary pressures are all uncertainties that force us to remain very flexible and to manage our business as well as possible in the short-term without hindering PUMA’s mid-term momentum. We see further upside on the revenue side, but also increased pressure on our OPEX and gross margin due to all the uncertainties. In this situation, we will continue to prioritize market share gains and our mid-term growth potential over short-term profit optimization. We will also continue to prioritize the health and safety of our people and not save on anything here. Now, this is especially important for all our employees and their families in Ukraine. The PUMA Family means more than profitability.”

FIRST QUARTER 2022

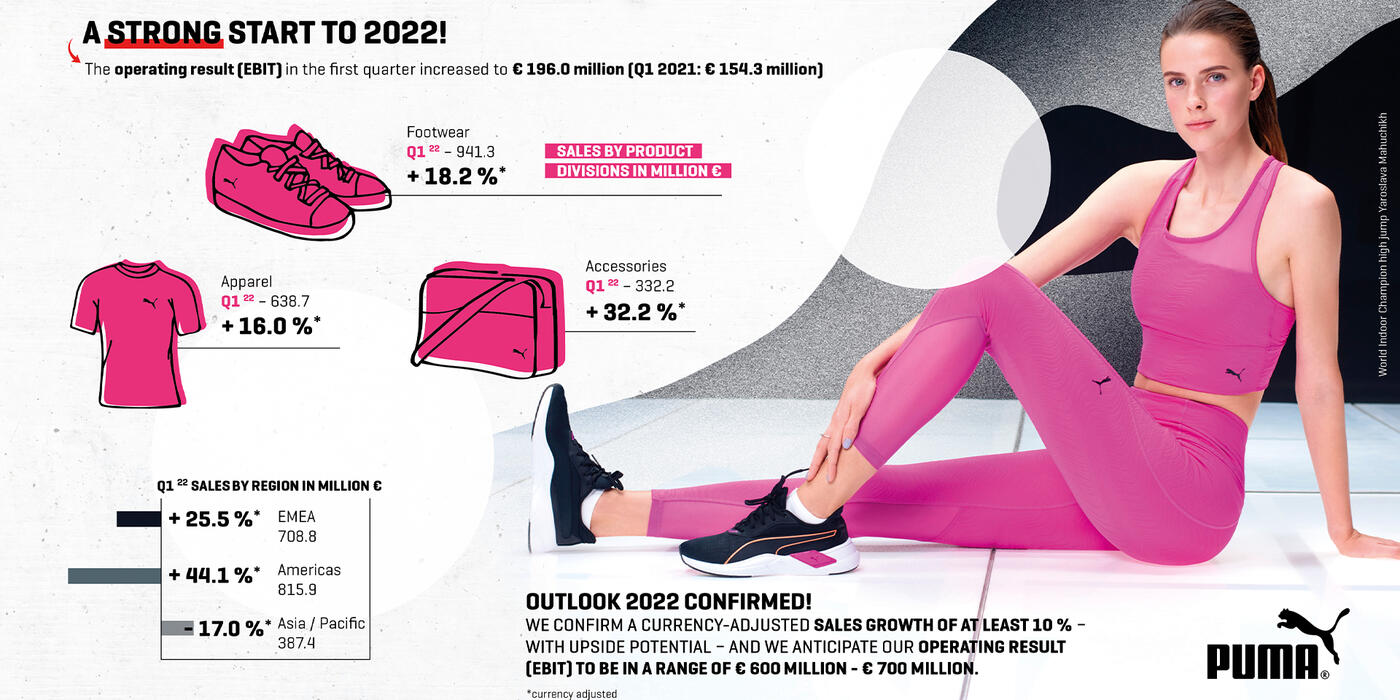

Sales increased by 19.7% (ca) to € 1,912.2 million (+23.5% reported). Americas reported the strongest sales growth of 44.1% (ca), driven by continued high demand for the PUMA brand in the North American and Latin American markets. Sales in EMEA were up 25.5% (ca), reflecting strong growth across all key markets in Europe. Sales in Asia/Pacific declined 17.0% (ca) due to the current market environment in Greater China resulting from COVID-19 related restrictions and geopolitical tensions. All product divisions grew double-digit with Footwear being up 18.2% (ca), Apparel 16.0% (ca) and Accessories 32.2% (ca). The growth was driven by a strong demand for our Performance categories like Running & Training, Teamsports, Golf and Basketball, as well as for the Sportstyle category.

PUMA’s Wholesale business increased by 23.3% (ca) to € 1,528.2 million and the Direct-to-Consumer (DTC) business was up by 7.1% (ca) to € 384.0 million. Sales in owned & operated retail stores increased 21.3% (ca) while e-commerce declined 13.2% (ca) as we continued to prioritize our retailers when supply was limited and due to the current market environment in Greater China.

The gross profit margin declined by 130 basis points to 47.2%, mainly caused by an unfavorable geographical and channel mix as well as higher freight rates while currencies had a slight positive effect. Operating expenses (OPEX) increased by 18.6% to € 712.8 million as a result of higher marketing expenses, more retail stores operating as well as higher sales-related distribution and warehousing costs. Despite ongoing operating inefficiencies due to COVID-19, especially in the supply chain, the OPEX ratio decreased to 37.3% (Q1 2021: 38.8%).

The operating result (EBIT) increased by 27.0% to € 196.0 million (Q1 2021: € 154.3 million). A strong sales growth and an improved OPEX ratio resulted in an EBIT margin increase by 30 basis points to 10.3% (Q1 2021: 10.0%).

Net earnings increased from € 109.2 million to € 121.4 million and earnings per share were up by 11.1% from € 0.73 in the first quarter of 2021 to € 0.81 in the first quarter of 2022.

WORKING CAPITAL

The working capital increased by 35.8% to € 1,004.8 million (March 31, 2021: € 740.2 million). Inventories were up by 32.2% to € 1,618.3 million (March 31, 2021: € 1,224.0 million) with most of the increase driven by Goods in Transit. Given the uncertainty about the impact of the COVID-19-related restrictions on our suppliers in Asia, we accelerated the delivery of our products wherever possible. Trade receivables increased by 23.0% to € 1,128.5 million (March 31, 2021: € 917.5 million) mainly as a result of strong sales growth. On the liabilities side, trade payables increased by 20.9% to € 1,275.0 million (March 31, 2021: € 1,054.9 million).

OUTLOOK 2022

PUMA has had a strong start to the year with a sales growth of 19.7% (ca) to € 1,912 million and an EBIT increase of 27.0% to € 196 million in the first quarter of 2022, underlining the continued momentum of the PUMA brand in a difficult market environment.

The year 2022 has again started with a high level of uncertainty in the global business environment. Several governments have implemented regional or country-wide restrictions due to a record high of COVID-19 infections, which continue to impact our value chain from manufacturing to retail store operations. The overall supply chain situation remains challenging due to port congestions, limited shipping capacities and continued freight rate increases. The crisis in Ukraine is having a direct negative impact - leading to lost sales and EBIT - and an indirect impact through the general tense geopolitical situation and increasing uncertainty worldwide. As a result, we continue to see inflationary pressures in all markets.

Despite the increasing uncertainties in 2022, we confirm a currency-adjusted sales growth of at least ten percent – with upside potential – in the financial year 2022. In line with our previous outlook we anticipate our operating result (EBIT) to be in a range of € 600 million and € 700 million (2021: € 557 million) and net earnings to improve correspondingly. The development of our gross profit margin and our OPEX-ratio in 2022 will continue to largely depend on the degree and duration of the negative impacts described above. While we will stay focused on our growth momentum by servicing our retail partners and consumers in the best possible way, we expect inflationary pressures from higher freight rates and raw material prices, as well as operational inefficiencies due to COVID-19 and the Ukraine crisis to dilute our profitability in 2022.

The achievement of this outlook is subject to continued manufacturing operations in our key sourcing countries in Asia and no major business interruptions due to COVID-19. In line with the previous years, PUMA will continue to manage the challenges short-term without hindering the positive mid-term momentum. The strong and profitable growth in the first quarter, a strong orderbook, an exciting product line-up as well as very good feedback from retailers and consumers make us confident for the mid-term success and growth of PUMA.