2021 First Quarter Facts

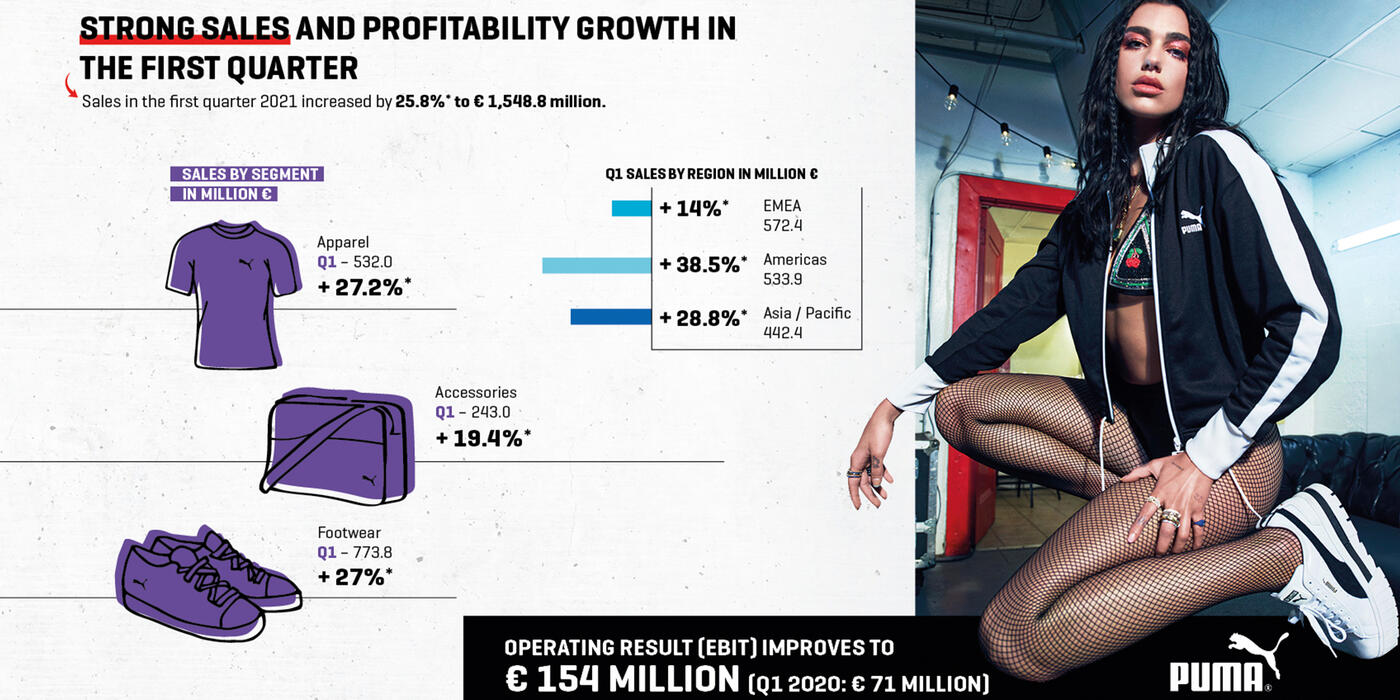

- Sales increase by 25.8% currency adjusted (ca) to € 1,549 million (+19.2% reported)

- Gross profit margin improves to 48.5% (Q1 2020: 47.6%)

- Operating expenses (OPEX) increase by only 8.6%

- Operating result (EBIT) improves by 116.7% to € 154 million (Q1 2020: € 71 million)

- Net earnings improve from € 36 million in Q1 2020 to € 109 million in Q1 2021

- PUMA launches the SHE MOVES US communication platform to celebrate women

- PUMA unveils ONLY SEE GREAT brand campaign to spark optimism and self-belief

- Neymar Jr. and PUMA launch a Creativity collection, featuring the FUTURE Z 1.1 football boot as well as shorts, training accessories and off-pitch apparel

- PUMA launches new running technology NITRO

- PUMA launches new RE:GEN collection that regenerates textile industry waste into new products

- PUMA’s new multi-channel distribution center in Geiselwind, Germany starts operations

Bjørn Gulden, Chief Executive Officer of PUMA SE:

“As expected, Q1 was a very strong quarter for PUMA. Despite a lot of COVID-19 restrictions and supply chain issues due to container shortages and port congestion, we delivered a 26% sales growth in constant currency to € 1,549 million and an EBIT increase of 117% to € 154 million. We achieved double-digit growth in all regions and product divisions and continue to see strong global demand for our products, both from consumers and retailers.

Despite the uncertainty about the longevity and impact of the COVID-19 pandemic, continued capacity issues and cost increases in global freight and a tense political situation between key regions that could have a negative impact on our industry, we feel confident that 2021 will be a better year than 2020. We believe that we should achieve a full-year sales growth in the mid-teens and that we will achieve a significantly better profitability compared to last year.

2021 will unfortunately be again a year with a lot of uncertainty which will make efficient operations and accurate planning difficult. Our objective continues to be maneuvering through this difficult time as well as possible in the short term without hindering the mid-term momentum of PUMA. We will continue to invest in product and marketing, strengthen our relationships with our retail partners and do everything we can to please our consumers.

The COVID-19 pandemic will probably continue to impact our industry throughout 2021, but we feel very confident for the mid-term future of PUMA and our industry.”

First Quarter 2021

Sales increased by 25.8% (ca) to € 1,548.8 million (+19.2% reported), despite COVID-19-related lockdown measures and supply chain constraints due to port congestion especially in North America. All regions and product divisions supported this sales growth with a currency-adjusted double-digit increase. Americas was up 38.5% (ca), driven by North America, Asia/Pacific grew 28.8% (ca), led by Greater China and EMEA was up 14.0% (ca), despite lockdowns in Europe. The growth was lead by Footwear (+27.0% ca) and Apparel (+27.2% ca), based on strong demand for our Running and Training as well as Sportstyle categories. Accessories growth was at 19.4% (ca), strongly supported by golf, as well as the leg- and bodywear business.

PUMA’s Wholesale business increased by 24.3% (ca) to € 1,202.0 million, despite lockdown-related store closures in several markets and supply chain constraints in North America. The Direct to Consumer business (DTC), which includes owned and operated retail stores as well as e-commerce, increased by 31.3% (ca) to € 346.8 million, driven by strong growth in e-commerce of 74.9% (ca).

The gross profit margin in the first quarter improved by 90 basis points to 48.5% despite negative currency effects. The improvement in gross profit margin was driven by a better sell-through of our products and less promotional activity.

Operating expenses (OPEX) increased by 8.6% to € 601.1 million due to higher sales-related, warehousing and distribution costs mainly driven by a strong increase in the e-commerce business as well as higher marketing investments.

The operating result (EBIT) in the first quarter increased significantly to € 154.3 million (Q1 2020: € 71.2 million) due to strong sales growth, higher gross profit margin and continued OPEX control. This resulted in an improved EBIT margin of 10.0% in the first quarter of 2021 (Q1 2020: 5.5%).

Net earnings increased significantly from € 36.2 million to € 109.2 million and earnings per share were up from € 0.24 in the first quarter of 2020 to € 0.73 in the first quarter of 2021.

Working Capital

We were able to reduce our working capital by 6.2% from € 788.7 million last year to € 740.2 million as of March 31, 2021. Inventories increased by 8.3% from € 1,129.9 million to € 1,224.0 million. Trade receivables were up 36.5% from € 672.0 million to € 917.5 million due to strong sales growth in March. On the liabilities side, trade payables increased by 42.1% from € 742.3 million to € 1,054.9 million due to extended payment terms agreed with our suppliers.

Outlook 2021

The year 2021 started with an all-time high of COVID-19 cases globally and continued restrictions for our operations in numerous markets. At the end of April 2021, approximately 30% of the retail stores selling our products in Europe and Latin America are still closed due to lockdown measures and the remaining 70% are mostly operating with significant restrictions. With global COVID-19 cases rising again sharply, we also see new restrictions and lockdowns in other parts of the world such as India, Canada and Turkey. By consequence, we foresee a continued negative impact of the COVID-19 pandemic on our business throughout 2021. In addition, supply chain issues due to container shortages and port congestion especially in North America as well as recent political tensions in key markets are also leading to increased uncertainty in our industry.

Despite all these uncertainties, our sales grew by 25.8% (ca) and our EBIT increased by 116.7% in the first quarter of 2021, underlining the relevance and momentum of our brand even in a difficult market environment. Given a strong first quarter, we are now in a position to further specify our initial outlook of “at least moderate sales (ca) growth with upside potential” to “mid-teens sales (ca) growth” for the full year 2021. Our outlook for both the operating result and net earnings has not changed and we continue to foresee a significant improvement compared to 2020 despite the global uncertainty regarding the COVID-19 pandemic. We do not provide a detailed outlook on our gross profit margin and our OPEX-ratio as their development will mainly depend on the duration and development of the COVID-19 pandemic and the timing and negative impact of corresponding restrictions on our sales.

We will continue to manage the negative implications of the COVID-19 pandemic as well as we can in the short-term and are convinced that PUMA will emerge stronger from this crisis. Our strong and profitable growth in the first quarter, a very positive orderbook and strong product pipeline for the rest of the year and very good feedback from retail partners and consumers make us confident for the mid-term success and growth of PUMA.