PUMA slightly adapts full-year guidance for 2018

2018 THIRD-QUARTER FACTS

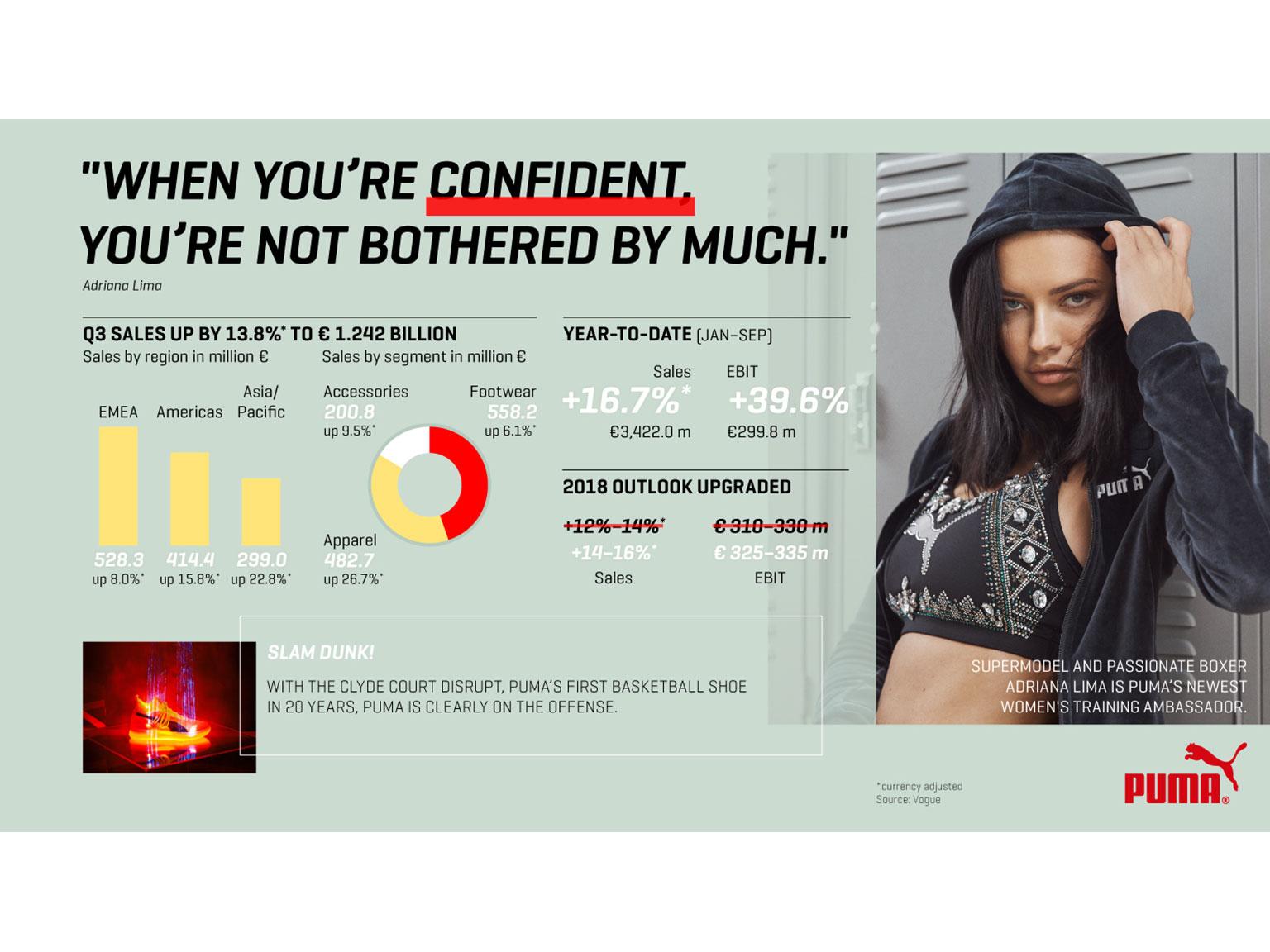

- Sales increase by 14% currency-adjusted to € 1,242 million (+11% reported) with double-digit growth in the Americas and Asia/Pacific regions

- Gross profit margin improves to 49.6%

- Operating expenses (OPEX) increase by 11% due to higher sales related variable costs and higher retail investments

- Operating result (EBIT) improves by 28% to € 130 million (last year: € 101 million) and EBIT-margin rises to 10.5% (last year: 9.0%)

- Successful US pre-launch of Basketball in late September

- PUMA signs supermodel Adriana Lima as women's training ambassador

- PUMA adds international star-players to its roster, including Barcelona and Uruguay striker Luis Suárez, Axel Witsel (Belgian national team and Borussia Dortmund) and Dejan Lovren (Croatian national team and FC Liverpool)

2018 NINE-MONTH FACTS

- Sales increase by 17% currency adjusted to € 3,422 million (+11% reported) with double-digit growth in all regions and product segments

- Gross profit margin up by 150 basis points to 48.8%

- Operating expenses (OPEX) increase 10% related to intensified marketing activities, higher sales related variable costs and higher retail investments

- Operating result (EBIT) improves by 40% from € 215 million to € 300 million and EBIT-margin increases from 6.9% to 8.8%

- Net earnings rise from € 134 million last year to € 176 million and earnings per share increase from € 8.94 last year to € 11.77 respectively

- Strong new style platforms Thunder and RS-0 established in the “chunky/ ugly shoe” category

Bjørn Gulden, Chief Executive Officer of PUMA SE:

"The third quarter ended a little stronger than we had expected with sales growing organically by 14% to €1,242 Million and EBIT increasing by 28% to €130 Million. This growth was achieved by a double-digit increase in both Americas and Asia/Pacific and high-single digit growth in EMEA. This improvement was further strengthened by a very positive development in Apparel, which grew 27% in the quarter.

Although we saw very negative currency impacts in Turkey and Argentina, overall we experienced less headwind from currencies in sales than in previous quarters.

We still see large shifts in product trends and consumer demand, but feel we have reacted fast enough to continue our growth.

The prelaunch of Basketball for North America at the end of the quarter created a lot of 'noise' and although it is very early days, the sell-through of our first shoe model has been very positive. This investment in Performance Basketball and the “Culture” around Basketball is a strong commitment to both the performance and the sportstyle business in the North American market.

Given the slightly stronger than expected third quarter and despite the uncertain business environment, with volatile currencies and an uncertain global trade environment, we now see our full-year organic sales growth between 14% and 16% and our full-year EBIT between €325 Million and € 335 million, which is a growth of at least 32% compared with last year."

Third Quarter 2018

PUMA's sales growth continued in the third quarter of 2018. Sales increased by 13.9% currency-adjusted to € 1,241.7 million (+10.7% reported). The Americas and Asia/Pacific regions contributed with double-digit increases, while growth in the EMEA region was at a high single-digit rate. The Apparel product segment was the main growth driver in the quarter, supported by new product launches in the Sportstyle, Teamsport and Motorsport categories. Footwear and Accessories grew at a high single-digit rate.

The gross profit margin improved by 150 basis points to 49.6% in the third quarter (last year: 48.1%). The increase is due to more sales of new products with a higher margin and further sourcing improvements as well as positive effects from the product mix related to Apparel.

Operating expenses (OPEX) increased by 10.6% to € 489.7 million in the third quarter. The increase of operating expenses is mainly due to higher sales related variable costs based on increased sales volumes and higher retail investments related to the increase of our retail store count.

The operating result (EBIT) rose by 28.4% from € 101.2 million last year to € 129.9 million due to a strong sales growth combined with an improved gross profit margin. This corresponds to an improvement of the EBIT-margin from 9.0% last year to 10.5% in the third quarter this year.

The financial result in the third quarter (€ -9.3 million; last year: € -3.4 million) was significantly impacted by currency losses mainly in Argentina and Turkey due to the weakness of those currencies versus the Euro and the US-Dollar. Taxes on income came in at a normalized rate of 27.4% (last year: 28.9%). Due to the improved results of the PUMA companies in which external companies hold minority interests, the net earnings to be distributed to these minority shareholders increased to € -10.1 million (previous year: € -7.4 million) in the third quarter (Net earnings attributable to non-controlling interests).

Net earnings increased from € 62.1 million to € 77.5 million and earnings per share were up from € 4.16 in the third quarter last year to € 5.18 correspondingly.

The operating result (EBIT) improved by 39.6% from € 214.8 million last year to € 299.8 million in the first nine months of 2018 due to a strong sales growth and a higher gross profit margin. This corresponds to an EBIT-margin of 8.8% compared to 6.9% in the nine-month period last year.

The financial result in the nine-month period (€ -22.7 million; last year: € -5.9 million) was strongly impacted by currency losses mainly in Argentina and Turkey. Taxes on income came in at a normalized rate of 27.6% (last year: 28.3%). Due to the improved results of the PUMA companies in which external companies hold minority interests, the net earnings to be distributed to these minority shareholders increased to € -24.5 million in the first nine months (previous year: € -16.2 million) (Net earnings attributable to non-controlling interests).

Net earnings grew by 31.7% and came in at € 176.0 million (last year: € 133.6 million). This translates into earnings per share of € 11.77 compared to € 8.94 in the first nine months of 2017.

Balance Sheet and Working Capital

Currency translation effects and our continued focus on working capital management led to a slight decrease of working capital of -0.1% to € 762.2 million. Without these currency effects, working capital would have increased by approximately 6%, which is lower than the growth in our business. Inventories were up by 11.6% to € 888.4 million and trade receivables rose by 3.7% to € 702.7 million. On the liabilities side, trade payables and other current liabilities increased by 15.5% to a total of € 1,012.6 million.

The one-off dividend payment this year and the refinancing of the PUMA group after the reduction of Kering’s shareholding in PUMA have led to major movements in current and non-current liabilities in the balance sheet.

Outlook 2018

The third quarter of 2018 saw a continued strong increase of sales and profitability, which was slightly above our expectations. As a consequence and based on the outlook for the remainder of the year, we slightly adapt our guidance for the full year 2018. PUMA now expects that currency-adjusted sales will increase between 14% and 16% (previous guidance: currency-adjusted increase between 12% and 14%). The gross profit margin is still anticipated to improve by approximately 100 basis points, while we now expect that operating expenses (OPEX) will increase at a low double-digit rate related to higher sales related variable costs (previous guidance: increase at a high single-digit rate). The operating result (EBIT) is now expected to come in between € 325 million and € 335 million (previous guidance: between € 310 million and € 330 million). In line with the previous guidance, Management still expects that net earnings will improve significantly in 2018.

Financial Calendar FY 2018:

February 12, 2018 Financial Results FY 2017

April 12, 2018 Annual General Meeting

April 24, 2018 Quarterly Statement Q1 2018

July 26, 2018 Interim Report Q2 2018

October 25, 2018 Quarterly Statement Q3 2018

The financial releases and other financial information are available on the Internet at „about.puma.com“.

Notes to the editors:

- The financial reports are posted on www.about.puma.com

- PUMA SE stock symbol:

Reuters: PUMG.DE, Bloomberg: PUM GY,

Börse Frankfurt: ISIN: DE0006969603– WKN: 696960

Notes relating to forward-looking statements:

This document contains forward-looking statements about the Company’s future financial status and strategic initiatives. The forward-looking statements are based on the current expectations and assumptions of the management team. These are subject to a certain level of risk and uncertainty including, but not limited to those described above or in other disclosures, in particular in the chapter Risk and Opportunity Management in the Group Management Report. In the event that the expectations and the assumptions do not materialize or unforeseen risks arise, the Company's actual results can differ significantly from expectations. Therefore, we cannot assume responsibility for the correctness of these statements.